US Debt is Increasing – Does it Matter

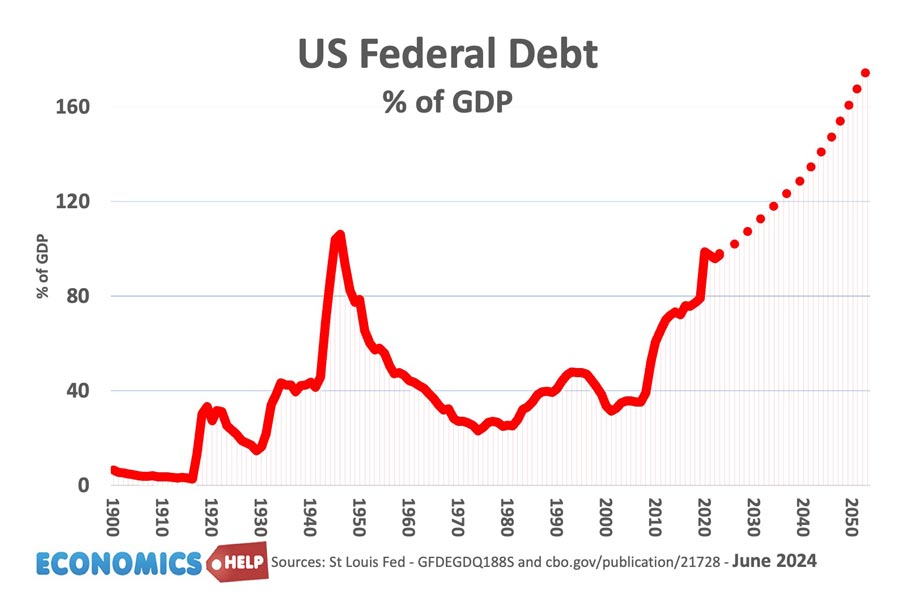

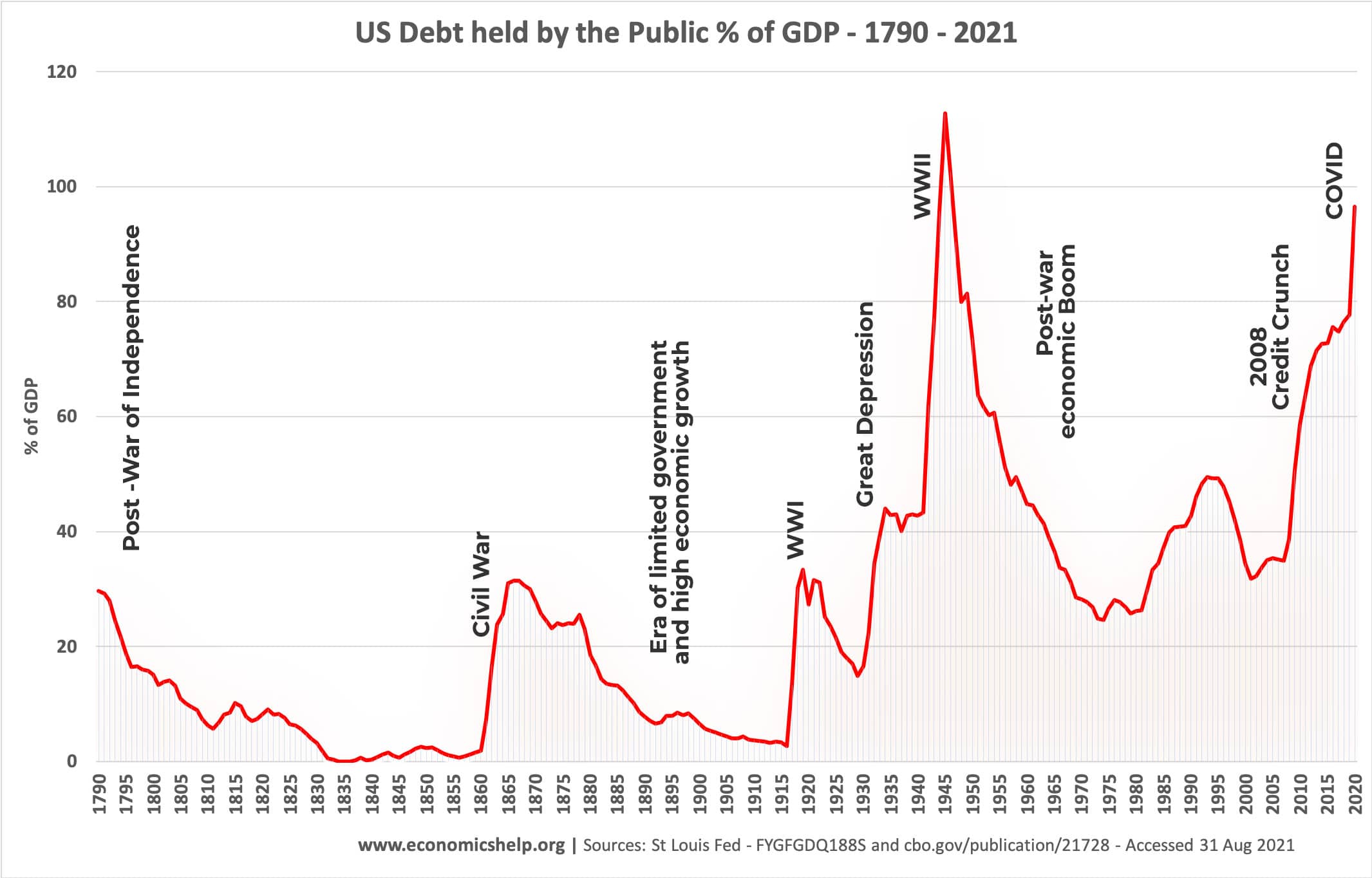

US Debt is Set to Massively INCREASE – Does it Matter?Watch this video on YouTube As a share of GDP, US debt is forecast to rise from the current level of 100% of GDP towards 180% by 2050. This is unprecedented – higher than the second world war. However, the recent budget resolution to …